The annual Ohio tax-free weekend can help you save on back-to-school shopping. Since 2019, Ohio Senate Bill 226 has provided a permanent sales tax holiday on the first Friday, Saturday, and Sunday in August each year. Here’s how to save the most money. The 2023 Ohio tax-free weekend starts at 12:00 AM on Friday, August 4 and runs until 11:59 PM on Sunday, August 6.

These are the items that are tax-free during the holiday:

- Clothing priced at $75 or less

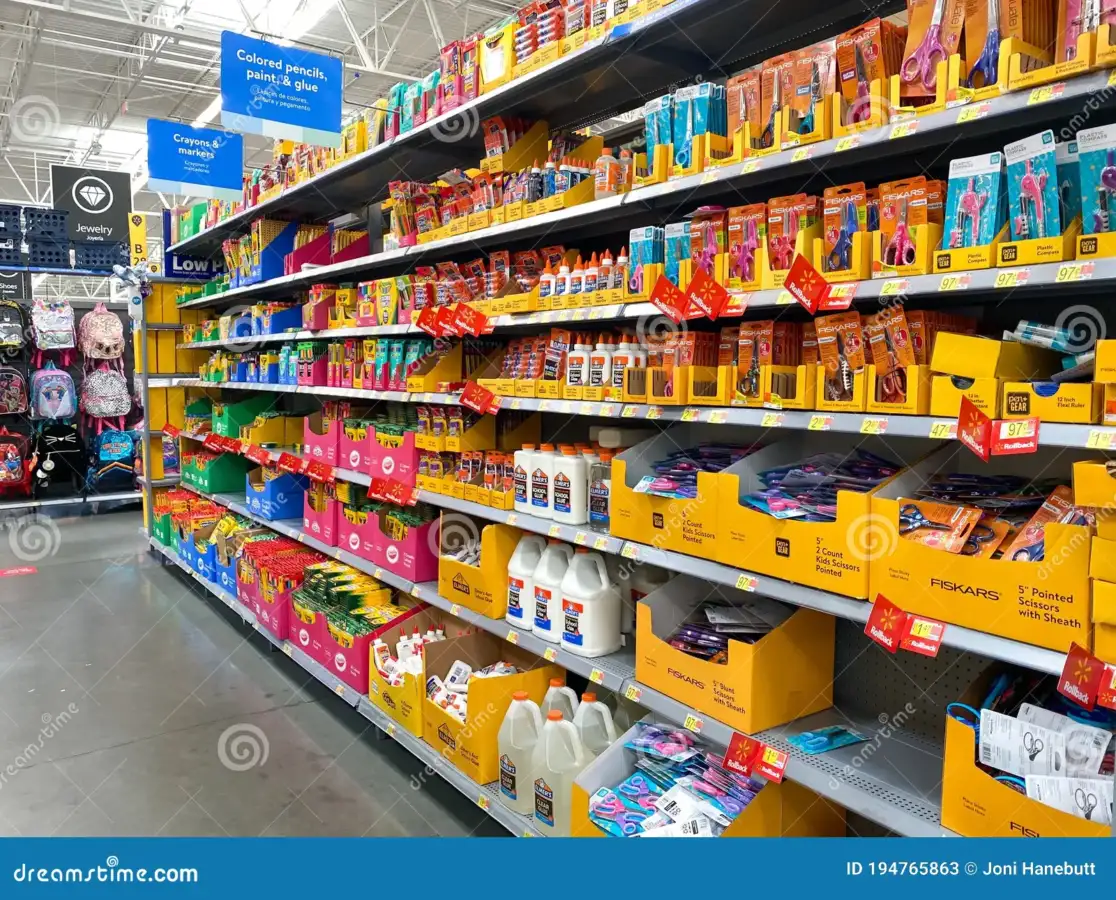

- School supplies priced at $20 or less

Eligible school supplies include:- Binders

- Book bags

- Calculators

- Cellophane tape

- Blackboard chalk

- Compasses

- Composition books

- Crayons

- Erasers

- Folders

- Glue, paste, and paste sticks

- Highlighters

- Index cards and index card boxes

- Legal pads

- Lunch boxes

- Markers

- Notebooks

- Paper, including ruled notebook paper, copy paper, graph paper, tracing paper, manila paper, colored paper, poster board, and construction paper

- Pencil boxes and other school supply boxes

- Pencil sharpeners

- Pencils

- Pens

- Protractors

- Rulers

- Scissors

- Writing tablets

- School instructional material priced at $20 or less

What items are not included in Ohio’s tax-free weekend?

The following items are subject to tax during the weekend:

- Items purchased for use in a trade or business

- Clothing accessories or equipment

- Protective equipment

- Sewing equipment and supplies

- Sports or recreational equipment

- Belt buckles sold separately

- Costume masks sold separately

- Patches and emblems sold separately

Items placed on layaway during the sales tax holiday are tax-exempt. Items picked up from layaway during the sales tax holiday are also tax-exempt. Coupons, discounts and loyalty cards can be used at individual retailers. If a retailer offers a discount to reduce the price of an eligible item to $20 or less for school supplies or $75 or less for clothing, the item will qualify for the exemption.

For internet orders, the rules state that if you order and pay for the item during the tax holiday and ship immediately, your item will qualify even if it’s delivered days or weeks later. You will also not pay tax on shipping and handling if all of your items in the shipment are eligible.

If an item is back-ordered and the website or retailer can’t take your order during the sales tax holiday, the item doesn’t qualify for the tax-free discount.

Qualifying items placed on or picked up from layaway during the sales tax holiday are also exempt from sales tax. There is no limit on the amount of the total purchase. The qualification is determined item by item.

For your online order to be tax-free, you must order and pay for eligible items during the sales tax holiday. According to the Ohio Department of Taxation, the retailer must also accept your order for “immediate shipment” during the three-day period.