During this unprecedented time, I wanted to share some of the real estate information and updates I have been receiving over the last week. If you are like many homeowners, I’m sure you have legitimate concerns about how the coronavirus pandemic is going to impact your home value and your mortgage, if you have one. I share those concerns and have been reading the best real estate information currently available, and wanted to share it with you. Obviously, this situation is fluid and rapidly changing, and as more news and information continues to come in,I will use this single post going forward to add any additional updates.

During this unprecedented time, I wanted to share some of the real estate information and updates I have been receiving over the last week. If you are like many homeowners, I’m sure you have legitimate concerns about how the coronavirus pandemic is going to impact your home value and your mortgage, if you have one. I share those concerns and have been reading the best real estate information currently available, and wanted to share it with you. Obviously, this situation is fluid and rapidly changing, and as more news and information continues to come in,I will use this single post going forward to add any additional updates.

This could get lengthy so I’m going to break this information up into a few sections. First section will be help and resources. This will be where you can find updates on what mortgage lenders and the government are doing to offer respite to homeowners who are facing economic hardship during the pandemic. I will then share how real estate professionals in all aspects of the home buying and selling process are changing the way we do business in order to keep everyone protected. Finally, I will share some of the most up-to-date information about home values and what experts believe we can expect in the aftermath of this pandemic. There is no doubt we are in for some difficult months ahead and while no one knows for certain what the future holds, I think it is important to face the future with as much solid information and knowledge as we have available to us- that’s my goal. Let’s get to it.

Help and Resources

*It’s imperative for you to take action if you have been laid off. Contact your lender as soon as possible.

*It’s imperative for you to take action if you have been laid off. Contact your lender as soon as possible.

We recently got news of a respite for FHA borrowers. All foreclosures and evictions are being suspended for 60 days for homeowners with an FHA loan for a single-family dwelling.

From the FHFA website:

“To help borrowers who are at risk of losing their home, the Federal Housing Finance Agency (FHFA) has directed Fannie Mae and Freddie Mac (the Enterprises) to suspend foreclosures and evictions for at least 60 days due to the coronavirus national emergency. The foreclosure and eviction suspension applies to homeowners with an Enterprise-backed single-family mortgage.”

In addition, FHFA is providing mortgage forbearance for borrowers impacted by hardship due to coronavirus. Forbearance allows for a mortgage payment to be suspended for up to 12 months.

You will need to contact your mortgage provider for details, and if you have been laid off, please don’t delay in contacting your lender.

You can read the entire FHFA press release here.

The Veterans Benefits Administration is encouraging lenders to offer mortgage relief programs to VA mortgage holders. You can read their press release here. If you are a VA mortgage holder facing economic hardship, please contact your individual mortgage provider to see what programs they might offer.

If you are a USDA mortgage holder, the USDA has informed lenders of a foreclosure and eviction moratorium for all USDA Single Family Housing Guaranteed Loans Program (SFHGLP) loans for a period of 60 days, in connection with the Presidentially declared COVID-19 National Emergency, read the press release here, and contact your mortgage provider for details.

Individual lenders have begun to post their own policies and ways for consumers to contact them for assistance, this is a list of known mortgage lenders and servicers who have set up programs to help homeowners. You will need to contact your mortgage provider or mortgage servicer directly for details, and if your provider is not on this list, but you are facing hardship, please contact them anyway as this list will be evolving.

Servicers (those who collect the payments for investors/banks and interact with consumers) are providing information for how homebuyers can reach out for assistance, I will add to this as I find more information:

Mr. Cooper

How the Buying and Selling Process are Changing

*As I was writing this blog post, Governor DeWine issued a Stay At Home Order for Ohio. The impact this will have on the economy is unknown right now, still, as we learned from the foreclosure crisis, it’s important to remember people are moving- people will continue to buy and sell homes, but the process of buying and selling is going to change. Real estate transactions already in progress should be able to carry on, but expect some delays and changes in how certain processes get done. A few things you can expect- you are going to see increased use of virtual tours and 3-D tours, and tools like Zoom. If you do physically show up at a home, you are likely to travel in your own car, you might be asked to wear footies, you might be asked not to touch surfaces like light switches and doorknobs, your agent might be using gloves or wipes to open doors… It’s going to be different and we are all doing what we can to continue to protect the public as much as possible. Here in Dayton, we were still accustomed to Round Table closings where the buyers and sellers all sit across the table from each other and paperwork gets passed from one person to the other. This is changing. Title companies are putting safe closing protocols into place, and the federal government is expected to pass legislation allowing for remote online notarizations nationwide, and lenders are taking applications via Zoom. Please keep in mind, Realtors and people working in the real estate industry are problem solvers. If you have any unique concerns or needs, please discuss with your Realtor. We are here to help and believe me, we get special needs requests on a regular basis, so don’t hesitate to discuss your concerns.

*As I was writing this blog post, Governor DeWine issued a Stay At Home Order for Ohio. The impact this will have on the economy is unknown right now, still, as we learned from the foreclosure crisis, it’s important to remember people are moving- people will continue to buy and sell homes, but the process of buying and selling is going to change. Real estate transactions already in progress should be able to carry on, but expect some delays and changes in how certain processes get done. A few things you can expect- you are going to see increased use of virtual tours and 3-D tours, and tools like Zoom. If you do physically show up at a home, you are likely to travel in your own car, you might be asked to wear footies, you might be asked not to touch surfaces like light switches and doorknobs, your agent might be using gloves or wipes to open doors… It’s going to be different and we are all doing what we can to continue to protect the public as much as possible. Here in Dayton, we were still accustomed to Round Table closings where the buyers and sellers all sit across the table from each other and paperwork gets passed from one person to the other. This is changing. Title companies are putting safe closing protocols into place, and the federal government is expected to pass legislation allowing for remote online notarizations nationwide, and lenders are taking applications via Zoom. Please keep in mind, Realtors and people working in the real estate industry are problem solvers. If you have any unique concerns or needs, please discuss with your Realtor. We are here to help and believe me, we get special needs requests on a regular basis, so don’t hesitate to discuss your concerns.

This is probably a good time to mention another safety concern- electronic fraud. This has been going on for some time, but we know the scope and techniques are rapidly increasing. This is important- never trust wiring instructions sent via email or even voicemail. Cyber criminals are hacking email accounts and voicemail and sending emails and messages with fake wiring instructions. These emails, texts, and voicemails are convincing and sophisticated. What you must do is to always independently confirm wiring instructions in person or via a telephone call to a *trusted and verified* phone number. Never wire money without double-checking that the wiring instructions are correct.

Home Values

There’s no getting around this- we are living in an unprecedented time and we do not know for certain what the future holds. That being said, there are people who are looking at data from the past to recognize trends and there is some information we can use to try to determine what we are headed for. One of the best things we can do to ease our fears is to educate ourselves with research, facts, and data. Digging into past experiences by reviewing historical trends and understanding the peaks and valleys of what’s come before us is one of the many ways we can confidently evaluate any situation. With concerns of a global recession on everyone’s minds today, it’s important to take an objective look at what has transpired over the years and how the housing market has successfully weathered these storms.

1. The Market Today Is Vastly Different from 2008

We all remember 2008. This is not 2008. Today’s market conditions are far from the time when housing was a key factor that triggered a recession. From easy-to-access mortgages to skyrocketing home price appreciation, a surplus of inventory, excessive equity-tapping, and more – we’re not where we were 12 years ago. None of those factors are in play today. Rest assured, housing is not a catalyst that could spiral us back to that time or place.

According to Danielle Hale, Chief Economist at Realtor.com, if there is a recession:

“It will be different than the Great Recession. Things unraveled pretty quickly, and then the recovery was pretty slow. I would expect this to be milder. There’s no dysfunction in the banking system, we don’t have many households who are overleveraged with their mortgage payments and are potentially in trouble.”

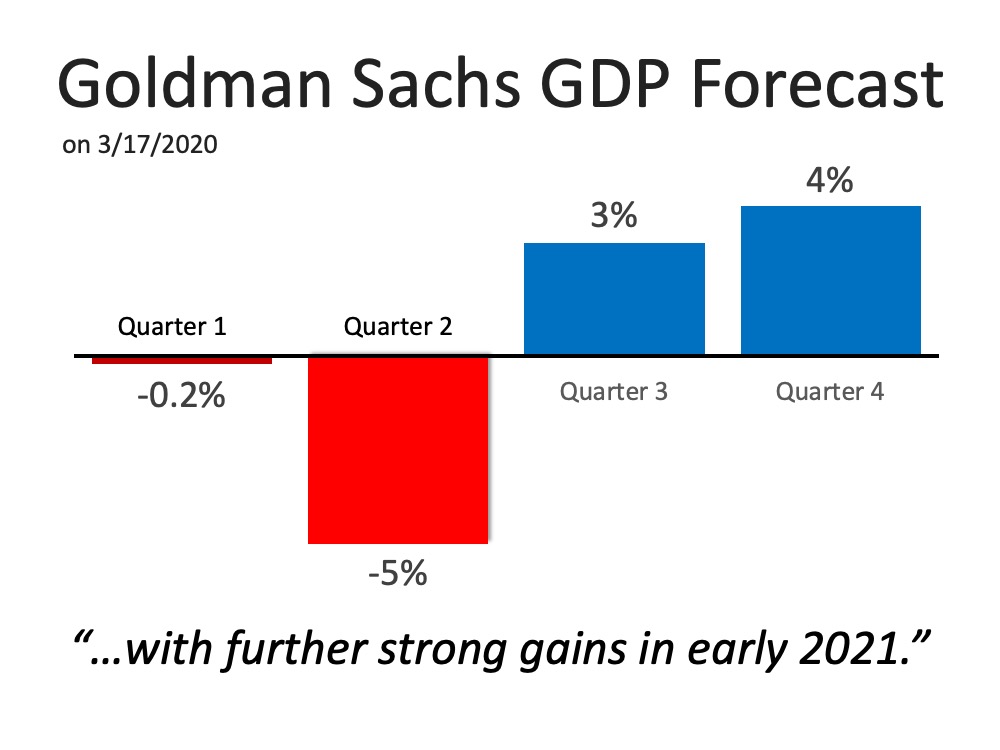

In addition, the Goldman Sachs GDP Forecast released this week indicates that although there is no growth anticipated immediately, gains are forecasted heading into the second half of this year and getting even stronger in early 2021. Both of these expert sources indicate this is a momentary event in time, not a collapse of the financial industry. It is a drop that will rebound quickly, a stark difference to the crash of 2008 that failed to get back to a sense of normal for almost four years. Although it poses plenty of near-term financial challenges, a potential recession this year is not a repeat of the long-term housing market crash we remember all too well.

Both of these expert sources indicate this is a momentary event in time, not a collapse of the financial industry. It is a drop that will rebound quickly, a stark difference to the crash of 2008 that failed to get back to a sense of normal for almost four years. Although it poses plenty of near-term financial challenges, a potential recession this year is not a repeat of the long-term housing market crash we remember all too well.

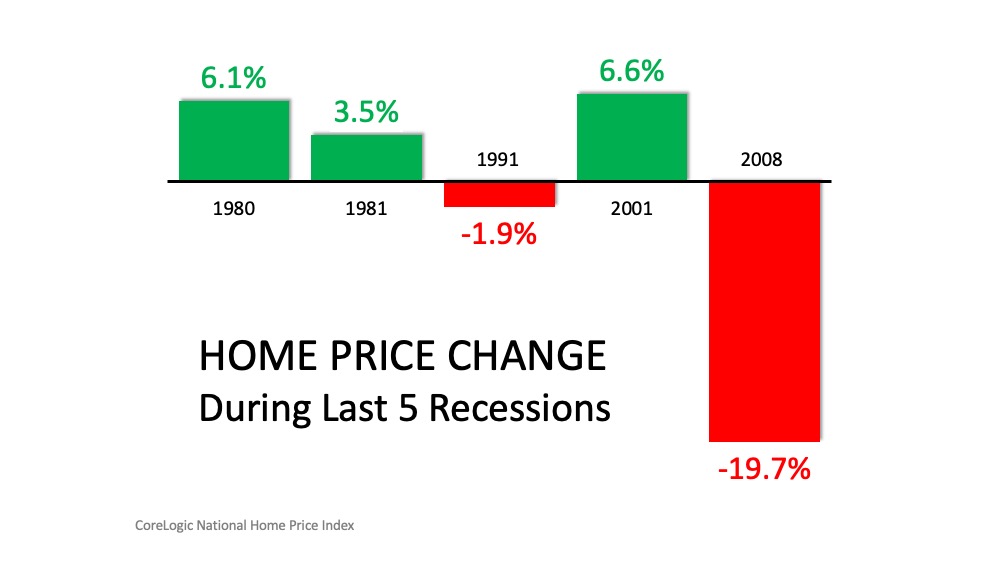

2. A Recession Does Not Equal a Housing Crisis

Next, take a look at the past five recessions in U.S. history. Home values actually appreciated in three of them. It is true that they sank by almost 20% during the last recession, but as we’ve identified above, 2008 presented different circumstances. In the four previous recessions, home values depreciated only once (by less than 2%). In the other three, residential real estate values increased by 3.5%, 6.1%, and 6.6% (see below):

3. We Can Be Confident About What We Know

Concerns about the global impact COVID-19 will have on the economy are real. And they’re scary, as the health and wellness of our friends, families, and loved ones are high on everyone’s emotional radar.

According to Bloomberg,

“Several economists made clear that the extent of the economic wreckage will depend on factors such as how long the virus lasts, whether governments will loosen fiscal policy enough and can markets avoid freezing up.”

That said, we can be confident that, while we don’t know the exact impact the virus will have on the housing market, we do know that housing isn’t the driver.

The reasons we move – marriage, children, job changes, retirement, etc. – are steadfast parts of life. As noted in a recent piece in the New York Times, “Everyone needs someplace to live.” That won’t change.

Bottom Line

Concerns about a recession are real, but housing isn’t the driver. And while there seems to be a lot of should-be and probably here, I heard an interesting comparison of what we faced in 2008 to what we face today and that is to think of 2008 as an economic tornado. We Daytonians know from first hand experience- a tornado comes in and destroys everything, and in the aftermath, everything needs to be rebuilt. That was the economic devastation we faced in 2008. What this pandemic is creating is more like an economic snowstorm. Things have shut down, we are certainly in for some difficult times, but hopefully once the snowstorm has passed, we can shovel out rather than rebuild everything. How deep will this recession go? How long will it last? Who exactly will be affected and how? No one knows for certain and we are only just beginning this process, but I can tell you from working as a Realtor during the 2008 recession- people still need and want to buy and sell homes, and there will be an end to this.

This is all a very fluid situation but we will get through this. I hope the information I have posted here is useful to you and your loved ones, and I will continue to update this post as things change, and if you have questions about what it means for your family’s home buying or selling plans, let’s connect to discuss your needs.

Stay healthy, stay strong, stay together!

While buying a home in Dayton Ohio is a process that tends to follow a predictable series of steps, some steps can be complex and may need more oversight to see them through successfully. Think of a real estate agent as a trail guide. They’ve been down this path many times before, they know where the tricky parts are and how to proactively navigate through those brambles. Having an experienced professional (that would be me!) guiding the process can help get your transaction completed smoothly. Let’s take a quick overview of each step:

While buying a home in Dayton Ohio is a process that tends to follow a predictable series of steps, some steps can be complex and may need more oversight to see them through successfully. Think of a real estate agent as a trail guide. They’ve been down this path many times before, they know where the tricky parts are and how to proactively navigate through those brambles. Having an experienced professional (that would be me!) guiding the process can help get your transaction completed smoothly. Let’s take a quick overview of each step:

I am a Dayton native. I left after graduating Fairview High School to attend Haverford College, graduate school at Western Reserve University, and military service in the Air Force in Turkey and Italy. I returned to practice dentistry for 50 years, much of that as a partner with my father, Dr. Jack Saidel. That was always my intention and I have fulfilled it happily.

I am a Dayton native. I left after graduating Fairview High School to attend Haverford College, graduate school at Western Reserve University, and military service in the Air Force in Turkey and Italy. I returned to practice dentistry for 50 years, much of that as a partner with my father, Dr. Jack Saidel. That was always my intention and I have fulfilled it happily. Now, we have entered the age when down-sizing is becoming a cogent decision. Both of us have dealt with the concept of a smaller residence. We realized that Dayton’s arts are the center of our life’s activities. This made downtown Dayton a major choice for us. Our move downtown puts us at the epicenter of the arts, music, dining and friends.

Now, we have entered the age when down-sizing is becoming a cogent decision. Both of us have dealt with the concept of a smaller residence. We realized that Dayton’s arts are the center of our life’s activities. This made downtown Dayton a major choice for us. Our move downtown puts us at the epicenter of the arts, music, dining and friends. We also need space for our relatives and children. We regularly fill our big home with their presence for family events. We also host many artists performing here for the opera, Vanguard concerts, etc. We knew a two- or even three-bedroom apartment would be too confining. Many visits to condominium-type dwellings yielded nothing that came close to our needs. We came upon an interesting concept, vertical rather than horizontal, that was advanced by Charles Simms in his design for Monument Walk.

We also need space for our relatives and children. We regularly fill our big home with their presence for family events. We also host many artists performing here for the opera, Vanguard concerts, etc. We knew a two- or even three-bedroom apartment would be too confining. Many visits to condominium-type dwellings yielded nothing that came close to our needs. We came upon an interesting concept, vertical rather than horizontal, that was advanced by Charles Simms in his design for Monument Walk. We know the Simms family well. Charlie, as the younger member, and his father Charles are experienced builders and good friends. And we know with Ann Simms looking over their shoulders, everything will be perfect.

We know the Simms family well. Charlie, as the younger member, and his father Charles are experienced builders and good friends. And we know with Ann Simms looking over their shoulders, everything will be perfect. Cincinnati native Jon White wasn’t happy stuck behind the wheel of his car. When the 31-year-old landed a job in Dayton, he initially tried to commute from his new job in Dayton back to his home in Cincinnati. But spending hours on the road took its toll on Jon, and he decided to find a new home that offered more freedom and flexibility. “I didn’t feel healthy commuting like that every day. I wanted to live close to work and close to entertainment,” Jon said. The location at Dayton Towers apartment complex

Cincinnati native Jon White wasn’t happy stuck behind the wheel of his car. When the 31-year-old landed a job in Dayton, he initially tried to commute from his new job in Dayton back to his home in Cincinnati. But spending hours on the road took its toll on Jon, and he decided to find a new home that offered more freedom and flexibility. “I didn’t feel healthy commuting like that every day. I wanted to live close to work and close to entertainment,” Jon said. The location at Dayton Towers apartment complex  checked off Jon’s requirements for proximity for 9-to-5 and 5-to-9 activities. “I bike to work just about every day,” he said. “and I still have easy access to the highway if I need to travel somewhere, and it’s a quick trip to access the bike trails for recreation.”

checked off Jon’s requirements for proximity for 9-to-5 and 5-to-9 activities. “I bike to work just about every day,” he said. “and I still have easy access to the highway if I need to travel somewhere, and it’s a quick trip to access the bike trails for recreation.” population is more dense, you’ll see more people, and when you walk or bike instead of drive, you have more interactions.” Within his own apartment building, Jon said he has met a wide range of ages and backgrounds of people who choose the convenience and excitement of downtown living. “There are families with kids, senior citizens, University of Dayton and Sinclair College students, young professionals like myself — people from all walks of life live here,” he said. “There’s a real sense of community.”

population is more dense, you’ll see more people, and when you walk or bike instead of drive, you have more interactions.” Within his own apartment building, Jon said he has met a wide range of ages and backgrounds of people who choose the convenience and excitement of downtown living. “There are families with kids, senior citizens, University of Dayton and Sinclair College students, young professionals like myself — people from all walks of life live here,” he said. “There’s a real sense of community.” Mingling with other Dayton Towers residents is how Jon met his group of friends, who enjoy Dayton Towers’ proximity to Oregon District businesses as well as theaters, art galleries, recreational activities, and other amenities within easy walking or leisurely bike riding distance. Of course hanging out on the patio or balconies is a popular choice with the amazing city views. Regardless of how he now spends his additional free time as a downtown resident, Jon said he’s happy with his choice to ditch the commute and dive into the live-work-play environment his downtown address provides. “It’s a lifestyle I prefer to have.”

Mingling with other Dayton Towers residents is how Jon met his group of friends, who enjoy Dayton Towers’ proximity to Oregon District businesses as well as theaters, art galleries, recreational activities, and other amenities within easy walking or leisurely bike riding distance. Of course hanging out on the patio or balconies is a popular choice with the amazing city views. Regardless of how he now spends his additional free time as a downtown resident, Jon said he’s happy with his choice to ditch the commute and dive into the live-work-play environment his downtown address provides. “It’s a lifestyle I prefer to have.”

Noah agreed and went on to describe how Stivers’ school pride impressed him. “The school had a gift shop; that was pretty different,” he said. One hurdle down: Noah auditioned and was accepted to Stivers’ choral program. He began his freshman year in August.

Noah agreed and went on to describe how Stivers’ school pride impressed him. “The school had a gift shop; that was pretty different,” he said. One hurdle down: Noah auditioned and was accepted to Stivers’ choral program. He began his freshman year in August.

Even though their new apartment home is physically smaller than their suburban digs, they said they don’t feel cramped or that they lack space. “There are so many places to visit and they’re practically in our back yard,” Kevin said. Giving one particular weekend as an example, the couple recounted attending a

Even though their new apartment home is physically smaller than their suburban digs, they said they don’t feel cramped or that they lack space. “There are so many places to visit and they’re practically in our back yard,” Kevin said. Giving one particular weekend as an example, the couple recounted attending a  From the Rehfuses’ home, perched on the banks of the Great Miami River, they will have front-row seats to watch more active lifestyle amenities come online. Construction has started on the new

From the Rehfuses’ home, perched on the banks of the Great Miami River, they will have front-row seats to watch more active lifestyle amenities come online. Construction has started on the new  The abundance of action wasn’t the only surprise

The abundance of action wasn’t the only surprise

Tilton’s Marathon Gas station, a Centerville Icon for 36 years, will close on March 29th forever. Known for car repairs and a convenient fuel stop at 199 N. Main Street, it has been a Centerville fixture in the community. The gas station and car repair bays are located across the street from Benham’s Grove on State Route 48.

Tilton’s Marathon Gas station, a Centerville Icon for 36 years, will close on March 29th forever. Known for car repairs and a convenient fuel stop at 199 N. Main Street, it has been a Centerville fixture in the community. The gas station and car repair bays are located across the street from Benham’s Grove on State Route 48.